And Just Like That… Phone-to-Satellite Connectivity Preps for the Masses

Satellite broadband products and services are expected to generate over $200 billion in annual service revenue by 2030, serving more than 350 million direct satellite-to-device subscribers. New Low Earth Orbit (LEO) satellite systems will provide connectivity where none exists, supporting the underserved and remote use cases. This brings new challenges of complexity that must be tested.

Climbing a mountain with no cellphone coverage and suddenly find yourself in an emergency situation? Just pull out your big, bulky, expensive satellite phone and make a call, right?

Well, no. That technology has never been in reach for the average consumer.

But that’s changing, fast.

In fact, if you have an Apple iPhone 14, you can now connect directly to satellites for emergency SOS. Sure, the bandwidth is painfully minimal, and you need to point directly at the satellite, but this is still a major milestone no matter how you measure it. Apple has already found workarounds to help users reach emergency services quickly. You can also use the Find My app to share your location via satellite with friends and family.

More improvements and innovations on this front are expected as the industry explores opportunities that connect devices and land-based networks directly to satellites.

This begs the question: is there finally a business case for mass market non-terrestrial connectivity?

Analysys Mason believes so, projecting satellite broadband products and services will generate $220 billion in annual service revenue by 2030, with more than 350 million direct satellite-to-device subscribers representing potentially $60 billion in annual revenue. This opportunity is being actively pursued by a growing number of satellite service providers.

So, what’s driving the demand?

Non-terrestrial network flexibility starting to shine

Non-terrestrial networks (NTNs) are positioned to take on long overdue connectivity feats, delivering:

- Connectivity to the underserved: In many situations, it is too costly or impossible to build traditional mobile infrastructure, resulting in some 750 million people around the world with no access to mobile broadband.

- Remote connectivity: 39% of the world’s population lives in rural areas where there is no viable business case to build and maintain remote infrastructure. Enterprises in the mining, oil and gas and agricultural sectors often lack remote connectivity because it isn’t economical.

- Mobile cell connectivity: New, low earth orbit satellites can provide premium mobile broadband access to airlines, ships, and high-speed trains, beyond basic voice access.

- Network resilience: Non-terrestrial networks can back up land-based networks in cases of war, cyberattacks, complete loss of connectivity during an extended network outage, emergency, and disaster situations.

- Edge network delivery: Large events, such as sporting matches or concerts, often take place in locations at the network edge that may be remote or lack the necessary capability to connect the edge cloud to the central network cloud.

All of these needs can be capably addressed by non-terrestrial satellite networks.

One of the most exciting areas for satcom and terrestrial mobile networks is around the fledgling satellite direct-to-phone service opportunity.

Today, terrestrial cell towers provide local coverage at limited range to mobile phones and devices. Expensive, proprietary, and standalone satellite phones, with accompanying subscriptions are required to access satcoms for connectivity. Going forward, the industry envisages a world where standard mobile phones can connect directly to satellites.

3GPP is planning this functionality as part of the Release 17 standards where future mobile phones supporting the n256 and n255 Frequency range 1 bands can access compliant satellite systems. New market entrants like Lynk are focusing on proprietary mechanisms to allow all mobile phones using current cellular frequency bands to connect direct to satellite.

Non-terrestrial satellite networks come in various flavors, each with strengths and weaknesses

Satellite networks have been available for a long time. But they’re evolving from massive, inflexible systems to smaller, software-driven constellations much closer to home. Let’s review the primary types.

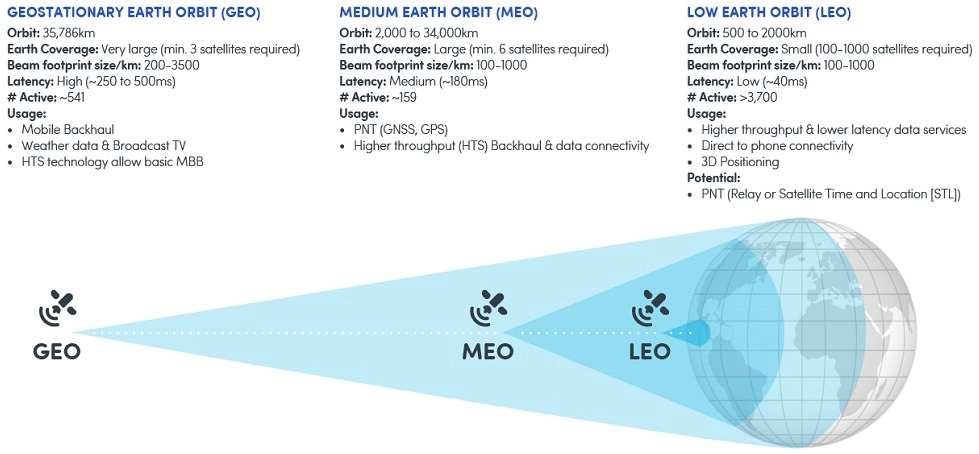

Geostationary Earth Orbit (GEO) were the first satellite networks. Because they’re over 35 thousand kilometers away, they can maintain a large coverage footprint with a minimum of three satellites covering 99.9% of the earth’s surface, albeit with high latency and interference challenges. They’re massive in size and costly, consuming high amounts of power to transmit all the way to earth. Today there are about 540 in orbit providing satcom services, including mobile backhaul, weather data and broadcast TV and high-throughput satellite (HTS) services for basic mobile internet.

Medium Earth Orbit (MEO) satellites can be two kilometers away or nearly as far as GEOs. Like a GEO, MEOs can serve large coverage areas with a small number of satellites. They are typically used to offer Positioning, Navigation, and Timing (PNT) services as well as higher throughput backhaul and data connectivity. Well-known PNT operators serving MEO’s include the US GPS satellite system Galileo, owned by the EU, and BeiDou from China. As with GEOs, MEOs suffer from high latency (average of ~180ms), making it harder for them to compete with mobile broadband services.

Low Earth Orbit (LEO) satellites have orbits as low as 500 kilometers, so they can deliver low latency, high throughput services. The challenge is that thousands of satellites are required in mega constellations to provide global coverage. Already, more than 3,700 LEO satellites have been deployed into active orbit.

LEOs are the new, game changing frontier

LEOs provide connectivity where there is none, satisfying the needs of underserved and remote use cases. They are software-driven, so provide the kind of flexibility that, for instance, enabled Starlink to quickly redirect satellites to support Ukraine—something that would have taken months for traditional military satellites.

A host of new LEO players are planning to launch mega constellations over the next five to ten years to unlock the $220 billion non-terrestrial network market opportunity. Starlink, OneWeb, Telesat, Kuiper (Amazon), Kepler and Galaxy Space are all involved. NTNs are maturing as they converge with 5G to provide better coverage, throughput, and lower latency. And satellite prices and costs are no longer a barrier to entry.

“A host of new LEO players are planning to launch mega constellations over the next five to ten years.

Leading terrestrial operators are assessing business cases and partnerships while assessing risks and rewards. They realize they need to engage ASAP. Partnerships have formed between operators and LEO service providers, such as AST SpaceMobile with Rakuten (investor), Vodafone (investor) and Orange, OneWeb with AT&T, SoftBank (investor) and Telefonica. Amazon/Project Kuiper is partnering with Verizon and Starlink with T-Mobile.

And it’s not just the traditional operators stepping up to the table. The cloud hyperscalers are also getting heavily involved so they can offer cloud or edge access anywhere across the globe. Microsoft Azure and Google Cloud are partnering with Starlink. Amazon is building its own LEO Project Kuiper, and partnering with others.

Industry excitement is high about the many revenue opportunities for the growing LEO NTN market. However, technical and commercial challenges still lie ahead. We will address them, as well as NTN standards and considerations for testing, in our next blog.